I love the feeling of a cool breeze on a hot and humid day! I have fans and air-conditioners to pump out cool breeze indoors when the sun is blazing outdoors. How awesome would it be to have a fan that circulates abundance instead of fresh air? Let’s explore the three factors that I believe, contribute to financial wellbeing.

Growing up with financial constraints, I fantasised about being rich and able to afford cool stuff and exclusive experiences. I liked to be nurtured by the energy of money. Well, I hear you; who doesn’t?

I started off earning money by running the proverbial “corporate rat race,” as most people do! When I entered my career, I thoroughly enjoyed the process of learning, growing, and developing myself. Honestly, building my career felt more like a dream come true for me than running a race. As the years passed on, my perspective began to shift.

After about 15 years of professional work, I craved to take a pause and rest a bit. Even though I was the secondary breadwinner in my family, it was not easy choosing to quit my thriving corporate career. All the previous choices I made with my family towards saving and investments paid off in the end. I was able to say goodbye to a sizeable salary without having to worry about my children’s education or my family’s lifestyle demands.

Lessons in Finance:

My formal education was in Accounting, Auditing, and Financial management. As a result, it is relatively easy for me to understand financial concepts and plan my finances. When any topic related to accounting, taxation, or even math, everyone looks towards me in unison, assuming I have the answers! As much as it is an opportunity to stroke my ego, I simply think it is funny.

And so, I become the de facto Finance head for our family budget. While the position was assigned based on my education, my real finance teachers were my parents. I learned so much of my financial life skills from my parents than any of my formal education could ever provide.

Financial Well-being:

Building upon the lessons from my parents, I learned more as I gained exposure to new jobs, countries, and people. The concept of moving from scarcity thinking to abundance thinking appealed to me, especially for wealth. I learned that my goal should focus on my financial wellbeing rather than just to get rich or crave for a luxurious experience.

I got a fresh understanding of financial wellbeing. My financial wellbeing allows me to feel abundance when I have enough to meet my needs and have a lifestyle I desire. This language of using financial wellness instead of wanting to become rich worked well for me. I am now able to share my musings on money in this perspective, without being a celebrity millionaire!

Unlike in the traditional definition of being wealthy, there is no society benchmark for financial wellbeing such as a luxury car, a fancy villa, or exotic vacations. Though, these could very well be in your list if you so desire them.

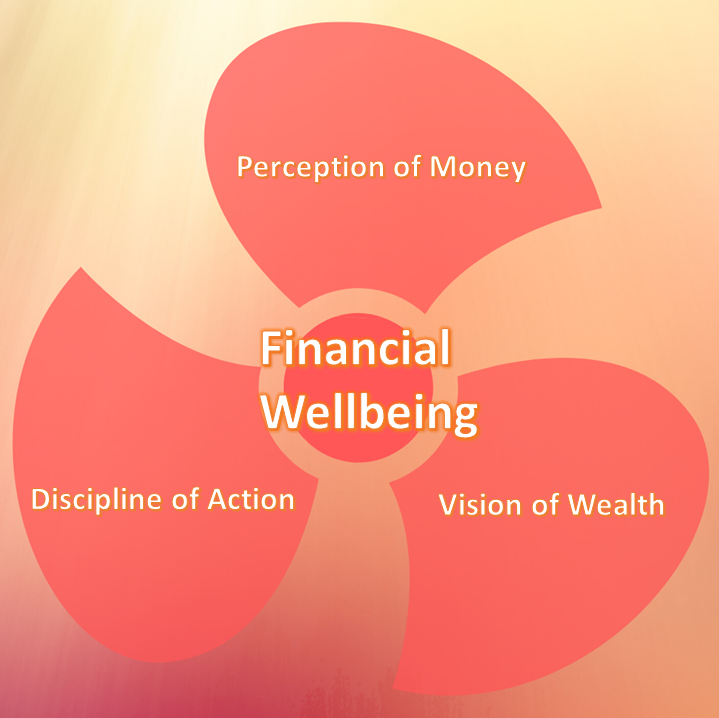

Here are the three broad factors attributed to my financial wellbeing that evolved organically over the last couple of decades of my life. These factors kept me focused on my financial wellbeing in the long run. What are the building blocks to build financial sufficiency?

I draw an analogy of the three factors to the arms on a table fan. When each of the arms is in place and integrated to work together, I could chill down and relax a bit especially, when I feel the heat of life!

Lets explore briefly by what I mean by each of the factors before we get into more details.

These are in my view the foundational pillars of wealth generation.

Perception of Money:

I have observed people perceive money depending mainly on their circumstances and conditioning they grew up. Another factor would be their unique experiences, challenges and how they responded to them.

Our unique relationship with money defines our perception. Some have a positive relationship with money, no matter how much or little they hold. Others tend to have a negative association with money, regardless of their possessions. I believe this perception tied with our subconscious relationship with money vastly determines whether they attract or repel the energy of money.

If you are familiar with the Laws of Attraction, this is an essential component of it. Without getting lost to the science or pseudoscience behind the laws of attraction, I would invite you to experiment and explore more into this to bring new possibilities in your life!

Perhaps you have encountered very ordinary people in life who have extra-ordinary generosity with money. Maybe you witnessed wealthier people who stinge on bare necessities. These examples have opposing views on how money is perceived and experienced.

Vision of Wealth:

The vision for financial wellbeing focuses on the amount of money you like to hold in the future. In other words, what is your long-term financial goal?

Put more practically, it is about your retirement planning, preparing for your children’s education, life contingency planning, etc. These goals set an appropriate target to cater to your personal needs.

When people are influential in their vision, even if they lack the other two factors, they mostly end up succeeding.

I like this story of the bollywood movie star Shahrukh Khan for the power of vision. As an ordinary man during his early days of career, he saw this beautiful mansion in Mumbai. He dreamt of living there one day, which he now proudly calls it home and people call it a ‘must-visit’ landmark in the city.

Discipline of Action:

Discipline I believe, is what I need when all the beautiful things on paper is put to test with reality. Everything that seemed so organised and clear tends to gets messy when it comes to action. The meticulous discipline for wealth generation comes from budgeting wisely, spending carefully, monitoring regularly, and, most importantly, making course corrections.

The discipline of action indicates not only the third arm of the fan, it also represents the movement of the fan that generates the breeze of money. When the discipline is sloppy, in my opinion, it fails to create the best possibility of financial wellness.

Let’s Reflect:

What are the factors that support your financial wellbeing?

Among these factors, which is your strength, and where do you struggle?

How could you create your financial wellbeing at its best?

Let’s do a deep dive into each of the three factors and equip you with more tools and practical guidance. Stay tuned for upcoming articles!